Does Google own the web? Biggest US antitrust lawsuit ever must break the tech giant's monopoly.

The latest DOJ trial against Google could force the company to split search from advertisements.

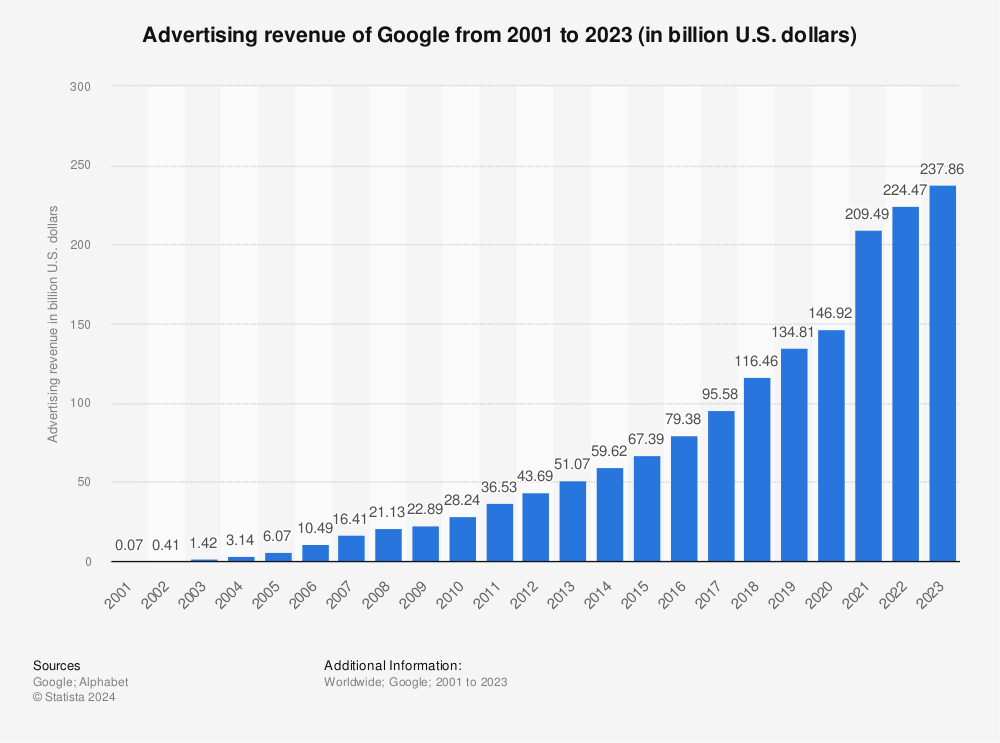

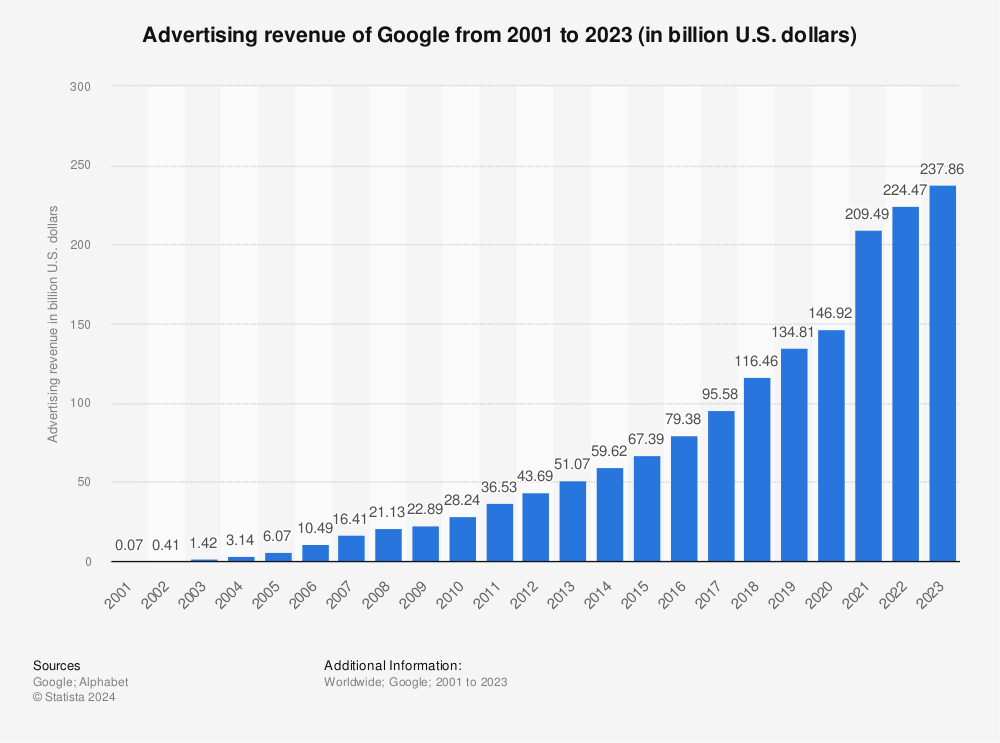

Antitrust lawsuit: USD 240 billion at stake

Google is known for its search monopoly, which is closely linked to another monopoly: the one in the ad marketplace. Almost all digital advertisers choose Google Ads to display ads on Google’s dominant search tool - it currently has a market share of ~90% in the US, and the picture is not much different in Europe. Once these businesses uses Google Ads for search ads, they also use this tool to configure display ads, which are then distributed across numerous websites. And there’s more: Google can not only display ads on third-party website via its network, but also on its own products, as you might have noticed ads when using Gmail on the browser or via the Gmail app.

With this smart set-up, that was strategically built over the last two decades, Google has achieved market dominance, which has now come under scrutiny by the US Department of Justice (DOJ).

There’s a lot at stake for Google: In 2023 Google earned almost USD 240 billion with its ad business. Legal limitations to that revenue stream pose a threat to the profits generated by Alphabet’s advertising powerhouse.

Dominance in Search, Google Play, and Ad-tech

What we know today as one of the biggest monopolists in tech started out very small: Two people, Larry Page and Sergey Brin, built their American Dream in a garage when they launched the Google search engine in 1998. Back then, they were the tiny newcomer that wanted to make the web more searchable, and while they achieved that, they also started abusing their power by downranking competitors in the search index.

The DOJ has now declared a war on Google - after watching its growth for decades. From search to email, to maps, even tablets and mobile phones, and most recently self-driving cars, Google’s growth seemed to be endless while antitrust watchdogs just stood by, doing nothing. This is changing now. Google today could be the most investigated tech company in the world with at least three antitrust lawsuits going on in the US right now.

The ad-tech trial comes shortly after a US judge ruled that Google built an illegal monopoly over the online search industry. Earlier this year, Google also lost an antitrust lawsuit surrounding Google Play, agreeing to pay 700 million USD.

To reach the top position in market share, Google did not always play fair. According to the DOJ’s antitrust lawsuit, Google used several strategic measures to achieve and maintain its dominance:

- Google acquired numerous companies to enhance their own business, or to stop competition from growing further, such as YouTube, which Google bought as a platform to advertise on, as well as ad-tech companies such as AdMob, Invite Media, Admeld.

- Google arranged deals with Verizon, Samsung, Apple, and other smartphone manufacturers so that Google Search is used as default on most phones you can buy today.

- Google made deals with developers of Internet browsers so that there, again, Google is the default search engine. Mozilla, for instance, gets around USD 510m to place Google Search as the default into Firefox as Fortune reports.

And this strategy has paid off: Google search is the dominant search engine in the US and in Europe so today Google is often referred to as the “gatekeeper for the internet.” And the company’s ad business is closely related to Google search, giving the tech giant an unfair advantage over its competition. Given that Google owns the web, the tech company can squash its competition and make billions with its monopoly profits, using the money to further fuel its monopoly - a circle that will never stop. Unless the DOJ now breaks up Google’s dominance.

As if Goldman Sachs owned the NYSE

In the US government’s complaint, one Google ad executive said that Google’s dominance could be compared to Citibank or Goldman Sachs owning the New York Stock Exchange (NYSE). The DOJ argued that Google did not reach this position with fair competition, but “by engaging in a systematic campaign to seize control of the wide swath of high-tech tools used by publishers, advertisers, and brokers, to facilitate digital advertising.”

The antitrust watchdogs explain that Google has the monopoly on the technology needed to match online publishers to advertisers. This technology was not only built by Google themselves, but also in large party acquired by taking over competition. Today, Google holds the highest market share both of the purchase and sale side of advertisements which allows the Silicon Valley tech giant to keep more than 30 cents of each dollar spent on ads; even though Google is just the broker between publishers and advertisers, not providing any content of its own.

While this business model of matching publishers with advertisers for targeted advertisements is not illegal as such, the DOJ claims that Google built its monopoly in an anticompetitive and unfair way, for instance by acquiring rivals and other anticompetitive actions.

Battle is on: “trifecta of Google monopolies” must be broken

”One monopoly is bad enough,” DOJ lawyer Julia Tarver Wood said. “But a trifecta of monopolies is what we have here.”

During the opening of Google’s antitrust trial, Wood told US District Judge Leonie Brinkema, who is ruling the case, that Google continues to “manipulate the rules of ad auctions to its own benefit. Publishers were understandably furious. The evidence will show that they could do nothing.”

The DOJ plans to call on executives from well-known publishers such as Disney, the New York Times, BuzzFeed, Vox and NewsCorp to give evidence.

Why Google’s dominance must be broken

The harm is obvious: By owning the ad-tech market, Google can set the prices, and, most importantly, take away a big chunk of profits from advertisers and publishers, namely more than 30 cents of every dollar spent on Google Ads.

The complaint by the DOJ in the antitrust trial against Google states:

“The harm is clear: website creators earn less, and advertisers pay more, than they would in a market where unfettered competitive pressure could discipline prices and lead to more innovative ad tech tools.” The document goes on saying: It “is critical to restore competition in these markets by enjoining Google’s anticompetitive practices, unwinding Google’s anticompetitive acquisitions, and imposing a remedy sufficient both to deny Google the fruits of its illegal conduct and to prevent further harm to competition in the future.”

In the end, everybody loses as higher prices are passed on to consumers as higher product prices advertised, or more expensive paywalls and subscriptions. So while everybody loses, Google wins with its exorbitant revenues that it brings in every year via targeted ads.

As targeted ads are debatable in general as they are infringing people’s privacy, there’s another important reason to break up Google’s dominance: Privacy. Google makes so much money

Google’s antitrust defense: “Our products are the best”

Google - given that it has billions of dollars to lose - denies all allegations and states that is has not used anticompetitive practices to reach its current market position. Instead, said that businesses choose Google Ads because it is the best tool around:

“It is simple, affordable, and effective.”

Adding in a statement:

“As we’ve said, this case is a meritless attempt to pick winners and losers in a highly competitive industry that has contributed to overwhelming economic growth for businesses of all sizes. We look forward to making our case in court.” The government’s trial “focuses on a limited type of advertising viewed on a narrow subset of websites when user attention migrated elsewhere years ago.”

By that, Google is referring to new advertising markets like TikTok, Instagram, and other social media platforms that also own a huge share of today’s advertising market.

On its blog, the company complained further:

“With the cost of ads going down and the number of ads sold going up, the market is working. The DOJ’s case risks inefficiencies and higher prices—the last thing that America’s economy or our small businesses need right now.” … “By picking winners and losers in a highly competitive industry, the DOJ risks making it more expensive for small businesses to grow and for websites and apps to make money. Let’s not break what’s working.”

In Google’s view winners would be Microsoft, TikTok and Amazon who already invest heavily in AI, which could have the entire ad scene changing soon.

Huge consequences at stake

Experts agree that this most recent antitrust trial against Google could be the most consequential compared to the other two about Google Search and Google Play. While the first two antitrust cases where rather vague in consequences, the trial about Google’s ad-tech dominance is very clear. In four to six weeks the judge will decide whether to follow the DOJ’s request to order a divestment of Google’s Ad Manager. The ultimate goal of the lawsuits is that Google no longer represents both advertisers’ and sellers’ interests, which could only be realized by removing the link between search and ads - which is exactly the unique selling point that Google currently owns.

If Google were required to sell off its ad business, this Google antitrust lawsuit “could potentially be more harmful to Google” than the search trial. Shubha Ghosh, an antitrust expert, explained to ArsTechnica: “if this case goes against Google as the last one did, it could set the stage for splitting it into separate search and advertising companies.”

However, Forbes concludes that no remedies will take place in the ad tech case in the near future. Should Google lose this lawsuit as well, the company will appeal against the court’s decision which means it will take years until anything is finally decided. And Google is sure to appeal at it has even more to lose than part of its business. According to Forbes, analysts said that “Google could see litigation from advertisers seeking monetary rewards totaling up to $100 billion.”

Huge consequences for privacy and freedom

While the consequences for Google could be devastating, they could be uplifting for freedom and privacy online.

As the web is currently owned by Google, there are numerous “free” products out there that Google cross-finances with its ad-revenue. Or, to be more precise, Google needs these free products to track its users for being able to post targeted ads to them, which in turn Google can sell to advertisers; thus, making its huge profits on the back of users of their seemingly free services.

The huge amounts of money Google has to invest into its “free” products, also pose a challenge to alternative, more privacy-friendly offerings online. These new tools that give the power back to the people can not enter the market on a level playing field, but need to compete against a giant with unlimited resources - which is close to impossible. Thus, the latest Google antitrust trial raises hopes that by breaking up Google and its invasive, targeted ad business, the internet as a whole will benefits, bringing forth great alternatives to Google products.